3 Reasons Affordability Is Showing Signs of Improvement This Fall

For the past couple of years, it’s been tough for many buyers here in Arlington, Dalworthington Gardens, and Pantego to make the numbers work. Home prices climbed quickly, mortgage rates followed, and a lot of people hit pause. Maybe you were one of them.

But here’s some encouraging news: if you’ve been waiting for a better time to jump back in, affordability is finally showing signs of improvement this fall.

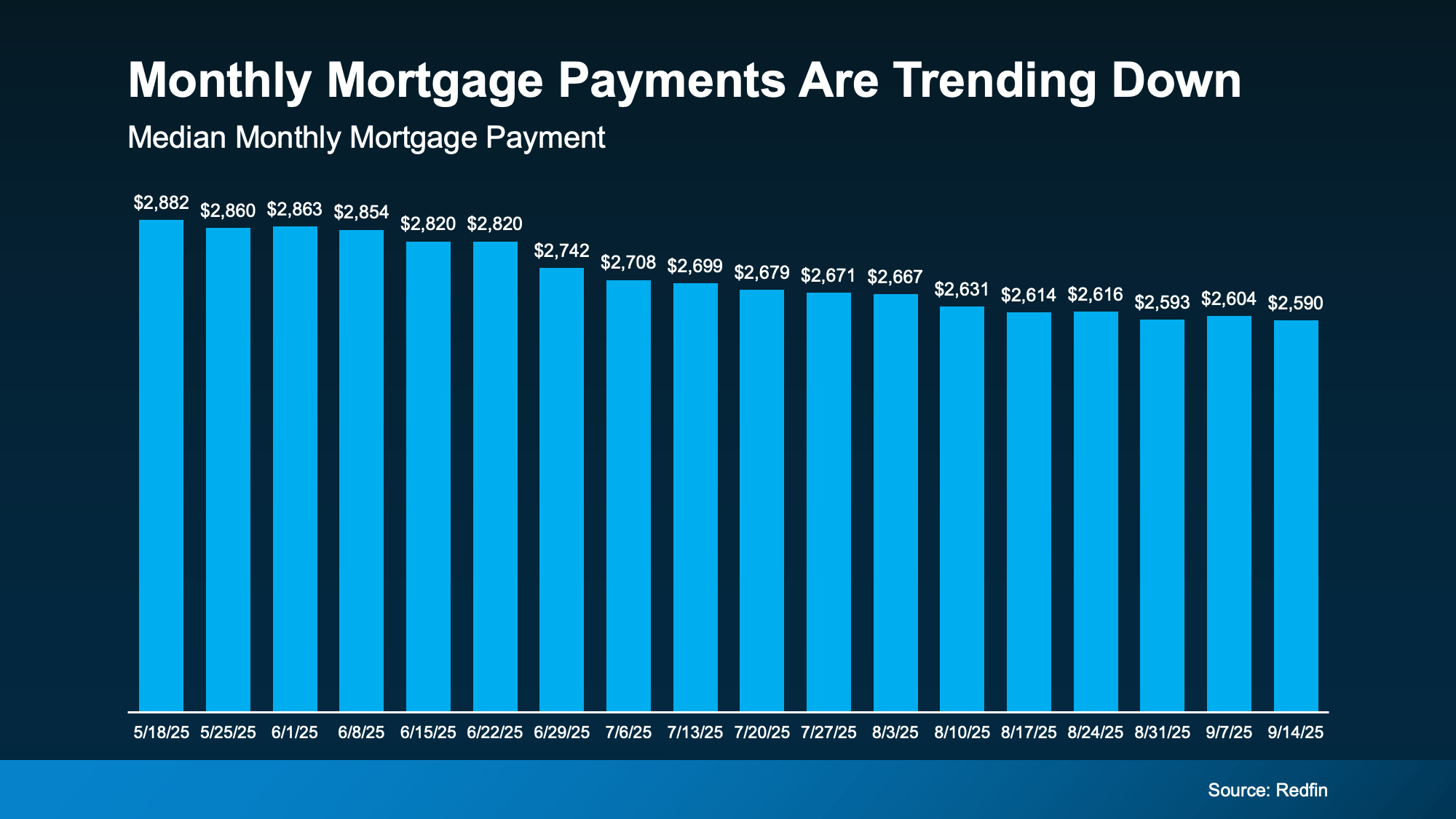

The latest data from Redfin shows the typical monthly mortgage payment has been coming down — about $290 lower than it was just a few months ago. That’s real relief. And here’s why it’s happening: affordability always comes down to three things — mortgage rates, home prices, and wages — and all three are finally moving in a better direction.

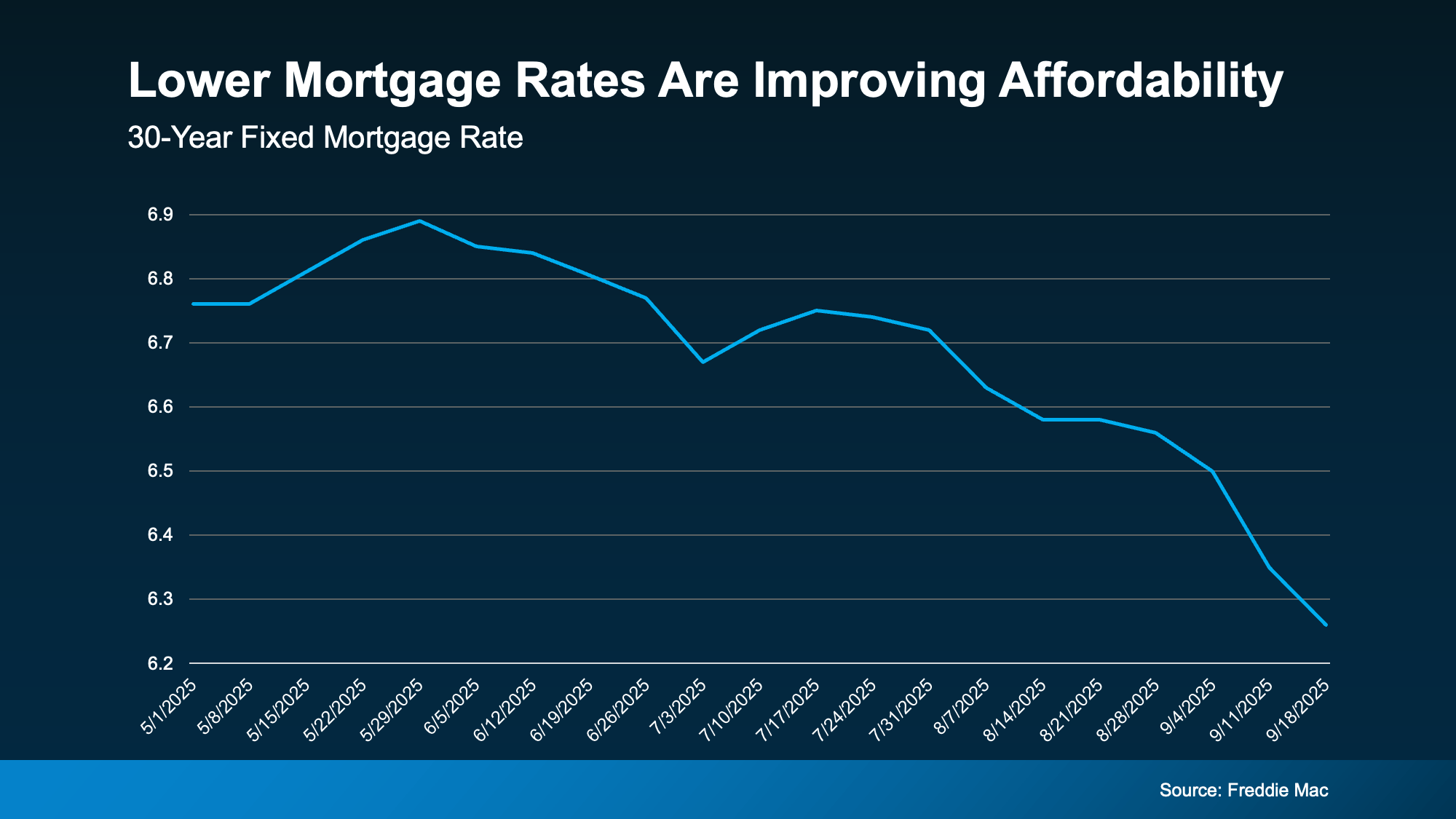

Mortgage rates have eased compared to earlier this year. In May, they were around 7%. Now, they’re closer to 6.3%.

That may not sound like much, but even a small shift can lower your monthly payment in a meaningful way. On a $400,000 loan, the difference between 7% and 6.3% is about $190 less per month. For many local buyers, that’s the piece that makes purchasing possible again.

As Joel Kan, VP and Deputy Chief Economist at the Mortgage Bankers Association, explained:

“The downward rate movement spurred the strongest week of borrower demand since 2022 . . . Purchase applications increased to the highest level since July and continued to run more than 20 percent ahead of last year’s pace.”

After several years of rapid price growth, things are finally moderating. Nationally, appreciation is holding in the low single digits, and in some pockets here locally, prices have even softened slightly.

As Odeta Kushi, Deputy Chief Economist at First American, notes:

“National home price growth remains positive, but muted — low single digits — and we expect this trend to continue in the second half of the year.”

For buyers in Arlington, Dalworthington Gardens, and Pantego, that means a little more predictability in planning your budget — and possibly some surprising opportunities if you’ve been priced out before.

According to the Bureau of Labor Statistics, wages are up about 4% annually. That’s now outpacing home price growth.

Lawrence Yun, Chief Economist at NAR, puts it this way:

“Wage growth is now comfortably outpacing home price growth, and buyers have more choices.”

That’s an important shift — your paycheck is stretching a little further than it did even a year ago. And in today’s market, every bit counts.

Lower rates. Slower price growth. Stronger wages. Put all three together, and buying a home this fall may finally feel more within reach.

While affordability is still a challenge, it’s easier today than it was just a few months ago — with the typical monthly mortgage payment already about $290 lower than earlier this year.

If you’ve been wondering whether it’s worth taking another look at buying, now’s the time to revisit the numbers.

At The Collective Living Co., we specialize in helping buyers and sellers in Arlington, Dalworthington Gardens, and Pantego navigate these shifts with clarity and confidence. Let’s sit down, review your budget, and see if this fall is the season you turn window-shopping into key-turning. 🏡

Stay up to date on the latest real estate trends.

Market Update

Market Update

Property Taxes

buyers